Personal Umbrella Vs Commercial Umbrella . umbrella insurance is especially beneficial for people with assets exceeding policy limits or at higher risk of. The key difference between commercial and personal umbrella insurance lies in the type of liability each policy. a commercial umbrella insurance policy covers the costs of legal expenses, medical bills, damage to someone else’s property and court judgments and settlements. a personal umbrella insurance, as the name suggests is suitable for individuals or families who want additional. Personal umbrella insurance typically supplements personal insurance policies held by. a commercial umbrella policy protects your firm against large losses by providing broader coverage on top of your primary liability policies. umbrella insurance is an essential component of a comprehensive insurance strategy, providing additional.

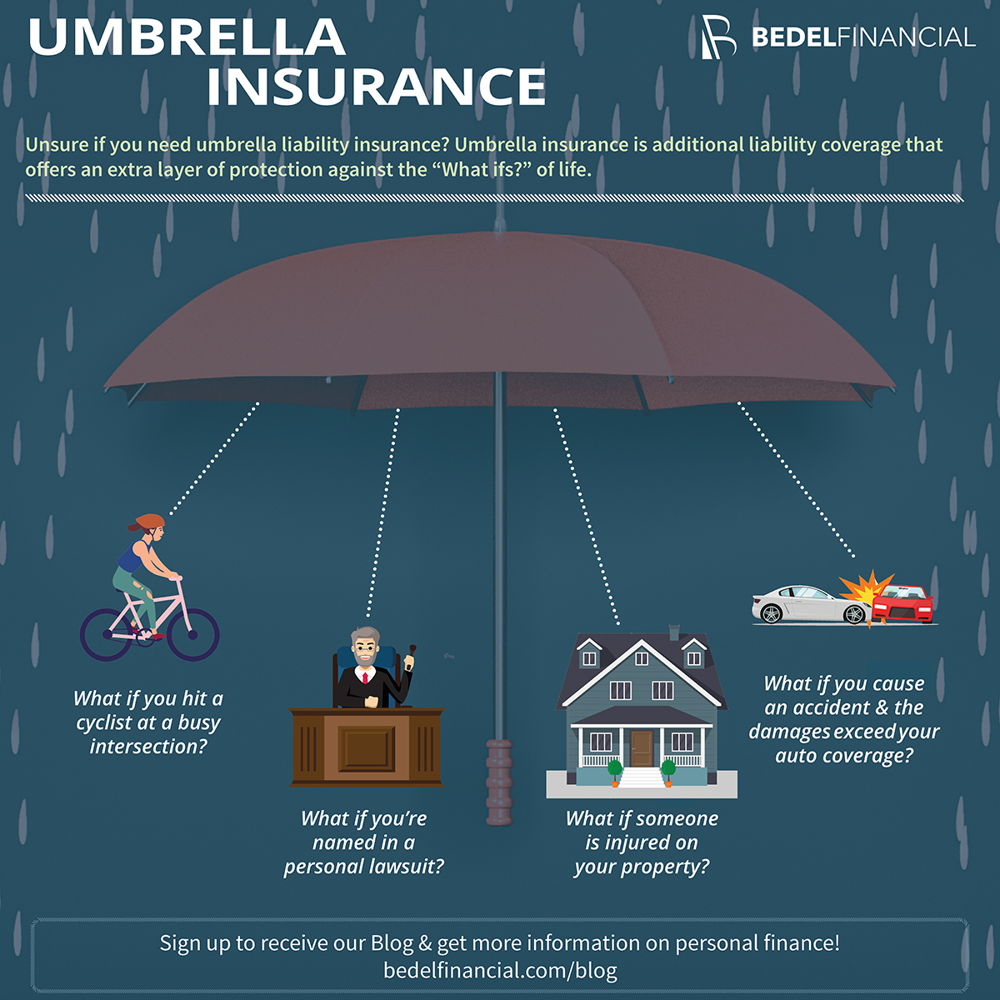

from www.bedelfinancial.com

a commercial umbrella insurance policy covers the costs of legal expenses, medical bills, damage to someone else’s property and court judgments and settlements. umbrella insurance is especially beneficial for people with assets exceeding policy limits or at higher risk of. umbrella insurance is an essential component of a comprehensive insurance strategy, providing additional. Personal umbrella insurance typically supplements personal insurance policies held by. The key difference between commercial and personal umbrella insurance lies in the type of liability each policy. a commercial umbrella policy protects your firm against large losses by providing broader coverage on top of your primary liability policies. a personal umbrella insurance, as the name suggests is suitable for individuals or families who want additional.

Umbrella Liability Insurance

Personal Umbrella Vs Commercial Umbrella a personal umbrella insurance, as the name suggests is suitable for individuals or families who want additional. a personal umbrella insurance, as the name suggests is suitable for individuals or families who want additional. a commercial umbrella policy protects your firm against large losses by providing broader coverage on top of your primary liability policies. umbrella insurance is especially beneficial for people with assets exceeding policy limits or at higher risk of. a commercial umbrella insurance policy covers the costs of legal expenses, medical bills, damage to someone else’s property and court judgments and settlements. umbrella insurance is an essential component of a comprehensive insurance strategy, providing additional. Personal umbrella insurance typically supplements personal insurance policies held by. The key difference between commercial and personal umbrella insurance lies in the type of liability each policy.

From www.forbes.com

The Importance Of Personal Umbrella Policies Personal Umbrella Vs Commercial Umbrella Personal umbrella insurance typically supplements personal insurance policies held by. a commercial umbrella policy protects your firm against large losses by providing broader coverage on top of your primary liability policies. a commercial umbrella insurance policy covers the costs of legal expenses, medical bills, damage to someone else’s property and court judgments and settlements. umbrella insurance is. Personal Umbrella Vs Commercial Umbrella.

From www.slrlounge.com

Softbox vs Umbrella Comparing Two Common Lighting Modifiers Personal Umbrella Vs Commercial Umbrella a commercial umbrella insurance policy covers the costs of legal expenses, medical bills, damage to someone else’s property and court judgments and settlements. umbrella insurance is especially beneficial for people with assets exceeding policy limits or at higher risk of. Personal umbrella insurance typically supplements personal insurance policies held by. a personal umbrella insurance, as the name. Personal Umbrella Vs Commercial Umbrella.

From exoflsnqz.blob.core.windows.net

Does An Umbrella Policy Cover Slander at Sabrina Norris blog Personal Umbrella Vs Commercial Umbrella a personal umbrella insurance, as the name suggests is suitable for individuals or families who want additional. The key difference between commercial and personal umbrella insurance lies in the type of liability each policy. a commercial umbrella insurance policy covers the costs of legal expenses, medical bills, damage to someone else’s property and court judgments and settlements. . Personal Umbrella Vs Commercial Umbrella.

From www.umbrellasdirect.com.au

Heavy Duty Umbrella Windproof Fibreglass Personal Umbrella UMBRELLAS Personal Umbrella Vs Commercial Umbrella a commercial umbrella insurance policy covers the costs of legal expenses, medical bills, damage to someone else’s property and court judgments and settlements. umbrella insurance is an essential component of a comprehensive insurance strategy, providing additional. a commercial umbrella policy protects your firm against large losses by providing broader coverage on top of your primary liability policies.. Personal Umbrella Vs Commercial Umbrella.

From www.umbrellasdirect.com.au

Heavy Duty Corporate Umbrella Windproof Umbrella with Fibreglass Frame Personal Umbrella Vs Commercial Umbrella umbrella insurance is especially beneficial for people with assets exceeding policy limits or at higher risk of. Personal umbrella insurance typically supplements personal insurance policies held by. a personal umbrella insurance, as the name suggests is suitable for individuals or families who want additional. umbrella insurance is an essential component of a comprehensive insurance strategy, providing additional.. Personal Umbrella Vs Commercial Umbrella.

From towum.com

Beach Umbrella VS Patio Umbrella Towum Factory Personal Umbrella Vs Commercial Umbrella a commercial umbrella insurance policy covers the costs of legal expenses, medical bills, damage to someone else’s property and court judgments and settlements. a commercial umbrella policy protects your firm against large losses by providing broader coverage on top of your primary liability policies. umbrella insurance is especially beneficial for people with assets exceeding policy limits or. Personal Umbrella Vs Commercial Umbrella.

From www.umbrellasdirect.com.au

STORM PROOF ECO®️ (RPET) Personal Compact Travel Umbrella Wind Proof Personal Umbrella Vs Commercial Umbrella umbrella insurance is an essential component of a comprehensive insurance strategy, providing additional. a personal umbrella insurance, as the name suggests is suitable for individuals or families who want additional. The key difference between commercial and personal umbrella insurance lies in the type of liability each policy. Personal umbrella insurance typically supplements personal insurance policies held by. . Personal Umbrella Vs Commercial Umbrella.

From www.primoproducts.co.nz

Pro Umbrella PrimoProducts Personal Umbrella Vs Commercial Umbrella a personal umbrella insurance, as the name suggests is suitable for individuals or families who want additional. umbrella insurance is especially beneficial for people with assets exceeding policy limits or at higher risk of. Personal umbrella insurance typically supplements personal insurance policies held by. a commercial umbrella policy protects your firm against large losses by providing broader. Personal Umbrella Vs Commercial Umbrella.

From www.bedelfinancial.com

Umbrella Liability Insurance Personal Umbrella Vs Commercial Umbrella Personal umbrella insurance typically supplements personal insurance policies held by. The key difference between commercial and personal umbrella insurance lies in the type of liability each policy. umbrella insurance is an essential component of a comprehensive insurance strategy, providing additional. umbrella insurance is especially beneficial for people with assets exceeding policy limits or at higher risk of. . Personal Umbrella Vs Commercial Umbrella.

From www.youtube.com

Personal Umbrella Vs. Commercial Umbrella InsuranceWhat Are the Personal Umbrella Vs Commercial Umbrella Personal umbrella insurance typically supplements personal insurance policies held by. a personal umbrella insurance, as the name suggests is suitable for individuals or families who want additional. umbrella insurance is an essential component of a comprehensive insurance strategy, providing additional. The key difference between commercial and personal umbrella insurance lies in the type of liability each policy. . Personal Umbrella Vs Commercial Umbrella.

From blog.cfmimo.com

Insurance That Educates Breaking Down How A Personal Umbrella Policy Works Personal Umbrella Vs Commercial Umbrella Personal umbrella insurance typically supplements personal insurance policies held by. a commercial umbrella policy protects your firm against large losses by providing broader coverage on top of your primary liability policies. umbrella insurance is an essential component of a comprehensive insurance strategy, providing additional. The key difference between commercial and personal umbrella insurance lies in the type of. Personal Umbrella Vs Commercial Umbrella.

From www.poggesiusa.com

Guide to Choosing the Best Commercial Outdoor Umbrella Personal Umbrella Vs Commercial Umbrella Personal umbrella insurance typically supplements personal insurance policies held by. a commercial umbrella policy protects your firm against large losses by providing broader coverage on top of your primary liability policies. umbrella insurance is especially beneficial for people with assets exceeding policy limits or at higher risk of. The key difference between commercial and personal umbrella insurance lies. Personal Umbrella Vs Commercial Umbrella.

From fabrikbrands.com

What Is An Umbrella Brand? Understanding Umbrella Branding Personal Umbrella Vs Commercial Umbrella umbrella insurance is an essential component of a comprehensive insurance strategy, providing additional. a commercial umbrella insurance policy covers the costs of legal expenses, medical bills, damage to someone else’s property and court judgments and settlements. a commercial umbrella policy protects your firm against large losses by providing broader coverage on top of your primary liability policies.. Personal Umbrella Vs Commercial Umbrella.

From globalpeo.com

What is an Umbrella Company? By GlobalPEO Personal Umbrella Vs Commercial Umbrella a commercial umbrella policy protects your firm against large losses by providing broader coverage on top of your primary liability policies. a personal umbrella insurance, as the name suggests is suitable for individuals or families who want additional. The key difference between commercial and personal umbrella insurance lies in the type of liability each policy. a commercial. Personal Umbrella Vs Commercial Umbrella.

From www.allstate.com

What Does a Personal Umbrella Policy Cover? Personal Umbrella Vs Commercial Umbrella a commercial umbrella insurance policy covers the costs of legal expenses, medical bills, damage to someone else’s property and court judgments and settlements. a commercial umbrella policy protects your firm against large losses by providing broader coverage on top of your primary liability policies. The key difference between commercial and personal umbrella insurance lies in the type of. Personal Umbrella Vs Commercial Umbrella.

From www.alibaba.com

Fully Automatic Custom Folding 3 Folded Umbrella With Custom Printed Personal Umbrella Vs Commercial Umbrella a personal umbrella insurance, as the name suggests is suitable for individuals or families who want additional. The key difference between commercial and personal umbrella insurance lies in the type of liability each policy. a commercial umbrella insurance policy covers the costs of legal expenses, medical bills, damage to someone else’s property and court judgments and settlements. . Personal Umbrella Vs Commercial Umbrella.

From mcl.accountants

What is an Umbrella Company & How Does It Work? Personal Umbrella Vs Commercial Umbrella umbrella insurance is an essential component of a comprehensive insurance strategy, providing additional. a personal umbrella insurance, as the name suggests is suitable for individuals or families who want additional. a commercial umbrella policy protects your firm against large losses by providing broader coverage on top of your primary liability policies. a commercial umbrella insurance policy. Personal Umbrella Vs Commercial Umbrella.

From au.davekny.com

Heavy Duty Umbrellas Luxury Umbrellas Quality Windproof Umbrellas Personal Umbrella Vs Commercial Umbrella a personal umbrella insurance, as the name suggests is suitable for individuals or families who want additional. The key difference between commercial and personal umbrella insurance lies in the type of liability each policy. a commercial umbrella policy protects your firm against large losses by providing broader coverage on top of your primary liability policies. umbrella insurance. Personal Umbrella Vs Commercial Umbrella.